Hello all, in light of the recent market news and economic policies coming into effect on a global scale, there has been much speculation around the future and growth prospects of many industries. The future of Real Estate is one that has come up frequently. Questions such as how the recently imposed tariffs will affect the Real Estate market as a whole, are great ones to ask. That’s a great question, and frankly, one that I have addressed a couple of times in the past few days. The short answer is in investor longevity, and the ability to navigate through the economic effects of market fluctuations using smart strategies, and having the holding power to do so.

I may have shared similar HUD/Census reports as the one attached, reflecting the long-term effects of volatile markets and recessions on the Real Estate market in the US.

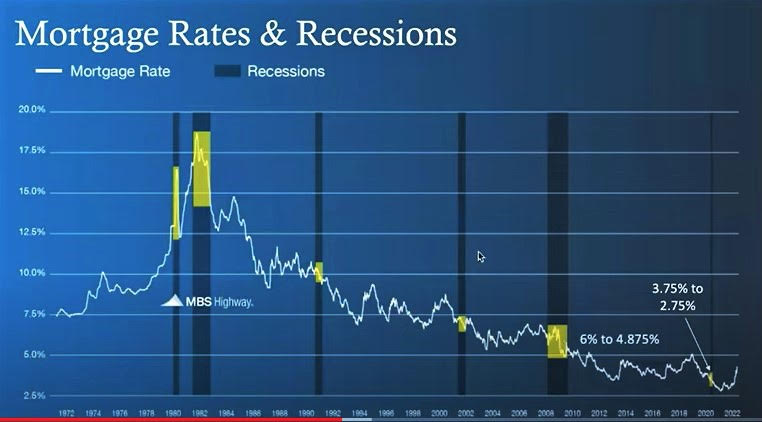

I was there through the market crash of 1987, the Savings & Loans failure in 1989-1990, aftermath of 9/11/2001, the 2008 Global crisis, and the Pandemic, and have seen the RE market trends soar back up again higher than before. Since I have lived in the DFW area through all of those periods, my experience has generally been that RE trends are more favorable compared to the rest of the US. That said, historical data shows that we can expect similar RE trends once investor sentiment is restored. I expect to see the same effects as early as Summer 2025.

On one hand, the Tariffs generate tax revenues paid for by exporters, importers and consumers (each product is different), and this is inflationary when importers and consumers pay the price. But the long play is it will bring down the interest rates and increase buying/activity especially in the Housing sector. The Commercial sector is affected less, since most developers have plans which take longer than these recession and adjustments in terms of lifecycle.

Bill Maher, a prominent critic of Donald Trump, stated during a sit-down with former CNN anchor Chris Cuomo :

‘Trump is one of the most effective politicians! Whatever you think of the policy and him as a person… just as a politician.’

I would also like to add that Trump’s foundation is Real Estate, and the end game here is to improve things within the US market.

In more news, Dallas billionaire, Mark Cuban, has posted on X his thoughts on the dynamics behind tariffs being imposed across the board with U.S. trading partners. The prominent Trump critic further shared his thoughts by stating, “…My money is on Trump winning!” To read further on this you can click this link.

While the real estate market is not experiencing the same effects as the stock markets – heeding the experience gained through the past episodes – we too have made some course adjustments to steer clear of pitfalls that investors fall into sometimes. These pitfalls include getting overwhelmed by too much news frenzy, and selling off of assets that are sure to rebound. In fact one of the more prudent and commonly used strategies during times like this, is to Buy when the market is down, and we have been!

I am confident we’ll get through the current panic mode soon as we have in the previous decades, and Real Estate prices will continue to appreciate across the nation and specifically, the Texas triangle. I’ll be happy to make myself available for any further discussion over the subject. Thank you all!

Best regards,

PG Ghassemi, Managing Director