There is a lot of misinformation about the market these days. Will there be a real estate crash? What will happen to mortgage rates? Is now a good time to buy? Today I will share with you some insights that I have gathered over the last couple of decades.

It is a fact that more and more younger generation professionals in America are losing confidence in the stock market and are betting on Real Estate instead.

Robert Kiyosaki, author of “Rich Dad, Poor Dad” recently wrote:

“Many of you know I do not invest in equities, bonds, ETS or MFs… What I’m going to say next is: ‘I would get out of paper assets’.” The world economy “is not a ‘market.’” he says. He adds the prudent thing to do is to invest more in Physical Assets such as real estate or gold instead. If you’re a fan of Gold, I can’t help you much there. But I do know a thing or two about real estate!

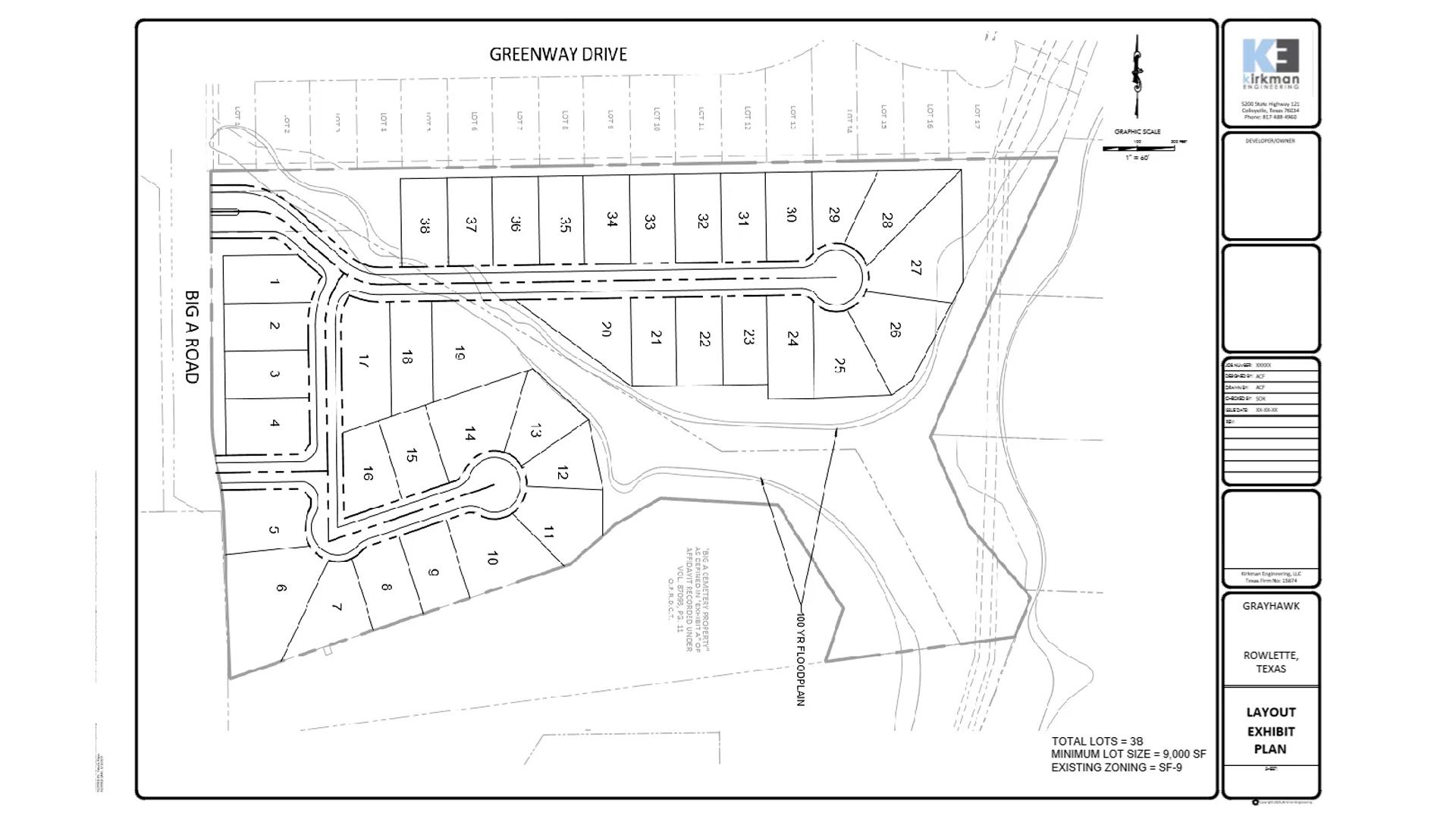

Looking at the Real Estate market trends it is hard to miss current and upcoming plans by major developers and other players (such as Tesla, Universal Studios, etc.) in the N. Texas area which is reflective of how the growing demand in this market is perceived and pursued. I believe we are going to continue enjoying a continuous uptick in the next 10 to 15 years with the focus being within the DFW-Austin-Houston triangle and surrounding markets.

Universal Studios Theme Park Coming To Frisco, Texas (msn.com)

Tesla – Austin

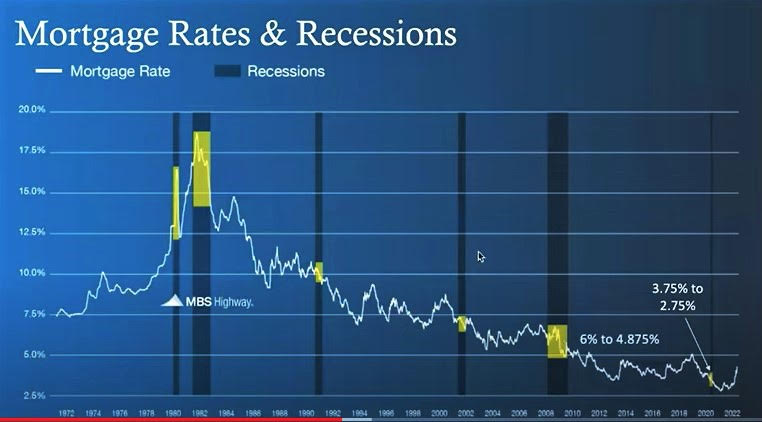

Nonetheless, many RE owners are alarmed by the rise in inflation and interest rates (which are mostly reactive to each other) and we see the dip in the prices that we do. But many investors who have not seen such a steep rise in interest rates as we are experiencing at the present for a long time, are also jaded and don’t know what to make of it!

For those of you who are in a holding position, attached is a chart that represents the Mortgage rate changes over the last 50 years, with the highlighted areas being periods of recession. As hindsight is 20/20 and one could clearly see, there is no need to panic. We have gone through much worse, and have always come out with the RE prices increasing yet higher every time!

Remember, in real estate, you always want to look at the long-term trends to gain the most benefits. So, the conclusion is with a lot of financial assets getting cheaper in this market downturn, there are many good opportunities that can be found out there. You just got to know where to look and how to look!

If you have thought of, but not made a decision to transform at least a portion of your assets into RE, it’s never too late! Get in now for strong long-term tailwinds.

If you have any questions regarding this or other subjects that I may be of help with some feedback, I am more than happy to make time and chat. Cheers, and invest smart!

* Disclaimer:

Real Estate investments are not all the same and may involve the risk of loss. The opinions on this blog represent the author’s perspective based on personal and professional experience. We cannot promise or foresee any market changes, nor be responsible for any potential outcome thereof.