The Real Estate market in the United States is a hot topic right now. With all the commotion, many friends and other investors have asked what my outlook is on the DFW market as an expert who’s been in it for the better part of the last 40 years. During this time, I have seen the downturns following major events such as the Market crash of 1987, 9/11, 2008, the Pandemic, and now, the inflation and current mess in world affairs.

It’s been a minute since I posted a blog, I thought this would help shed some light on the current state of the Real estate market in our area. So here’s a bit of my perspective, and you can take it as you wish.

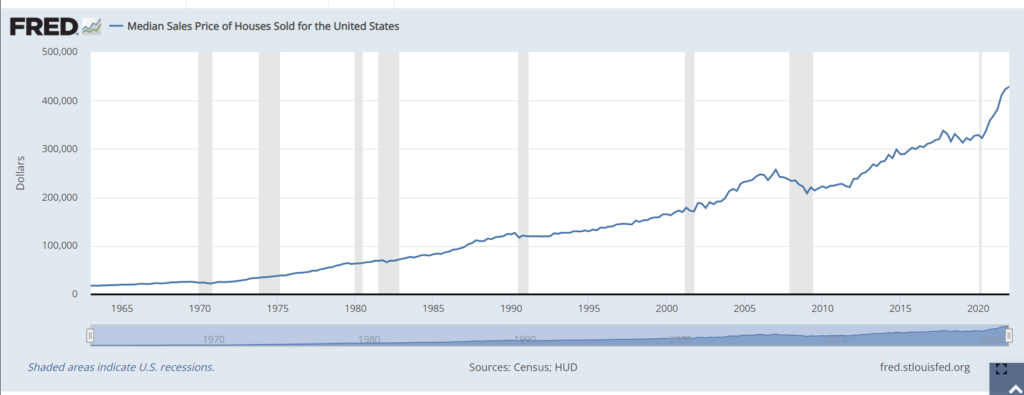

First, please consider the chart below which is a representation of the 60-yr market trend for housing values in the US, in which the Gray shaded areas are periods of recession.

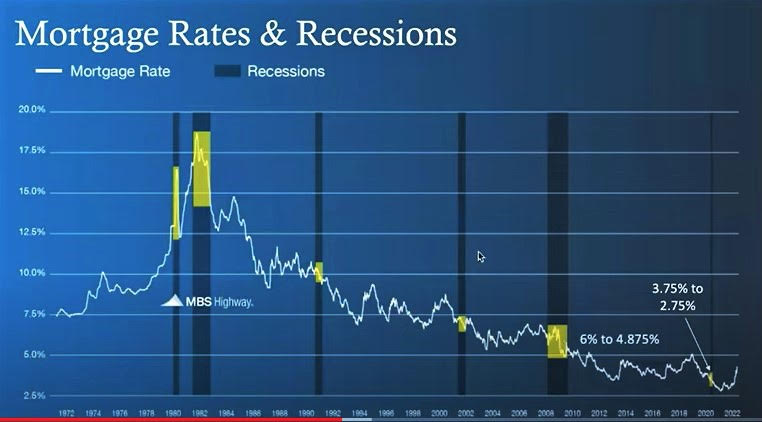

Could a recession happen and cause prices to drop? Sure, and almost every time that median home prices did decline in the past was during a recession. Mortgage rates are also rising, which makes financing homes more expensive, and could help cool demand from buyers, as quickly as they have risen so far this year.

Ultimately, you need Low demand for housing to fall, in order for prices to fall. A recession or rising rates can have that effect, but nobody can know for sure when, or by how much. But in the development and Rehab business, we still have a bright outlook for the 2023 market and beyond, which is when most of our products will be ready for sale!

One of the unintended consequences of the housing crash in 2007 was that demand dropped so rapidly, that home builders basically shut down. The recovery of housing starts took a couple of years following the crisis, and today it’s estimated that America is short roughly 5 million single-family homes.

Also, Real Estate at large is Not simply the Housing Market! There is the Commercial market, Developments, and Rehabs and it goes on!

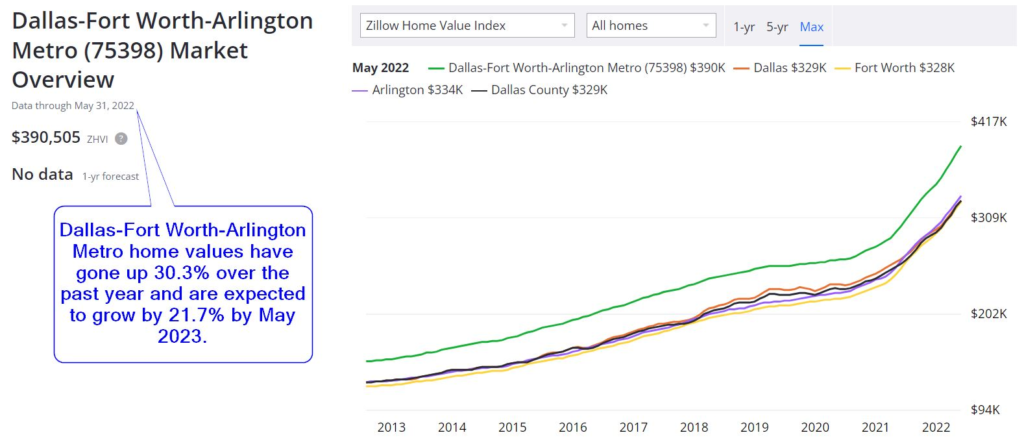

Let us look at the housing price trends recorded by Zillow over the past few years. Since the last decade (July 2012), the DFW metro area home values have appreciated by nearly 162% — Zillow Home Value Index. For your information, ZHVI is a seasonally adjusted measure of the typical home value and market changes across a given region and housing type. It reflects the typical value for homes in the 35th to 65th percentile range.

In summary, don’t believe that the housing market will “crash” in the US and certainly not in our market. Historically, real estate has proven very resilient, with median home prices temporarily declining in just eight of the past 60 years. This is especially true in the DFW area where we still see an inflow of population and steady demand for housing.

I hope this helps give some more insight to those who are concerned about all the news in the media and frankly, it’s hard to sort it all out. I would be happy to discuss any questions by email or if you’d like to do a one-on-one.

Cheers, and happy investing!