The annual forecast from PriceWaterhouseCoopers and the Urban Land Institute dubbed D-FW as the best place to buy, build and finance property in the year ahead.

The report, Emerging Trends in Real Estate, compiled data from more than 2,000 industry experts and their insights were used to provide an outlook on real estate investment, development trends and other real estate issues across the country.

North Texas improved upon its third-place ranking for 2024. D-FW has ranked in the top 10 for the last six years. D-FW also took the top spot in 2019.

D-FW earned its ranking as the top market to watch thanks to its “enviable” post-pandemic recovery, its size and its continued demographic growth, according to the report.

The region’s total employment has grown 11.2% since February 2020, the fourth-fastest among metros in the nation. D-FW trails only Sunbelt peers in Raleigh, North Carolina; Charleston, South Carolina; and Austin, Texas.

The report also touts D-FW’s economic diversity. North Texas is home to 23 Fortune 500 companies, the fourth largest concentration in the country.

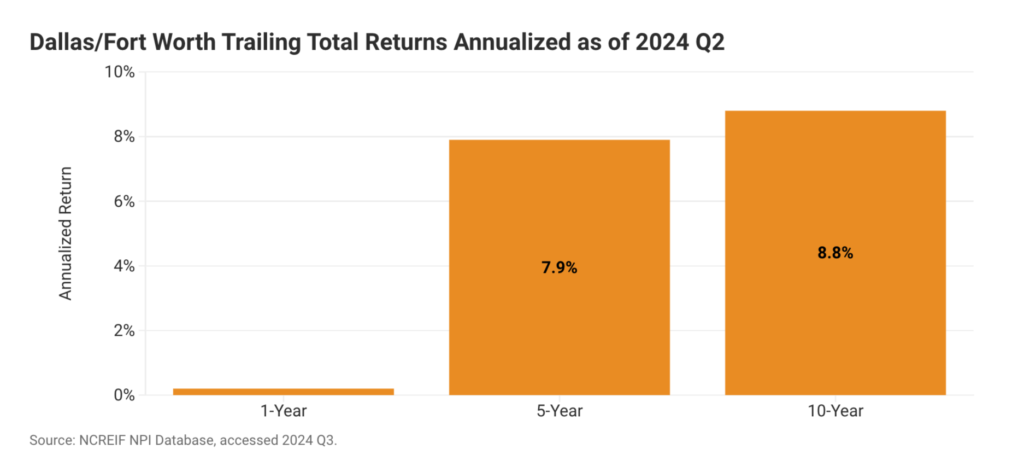

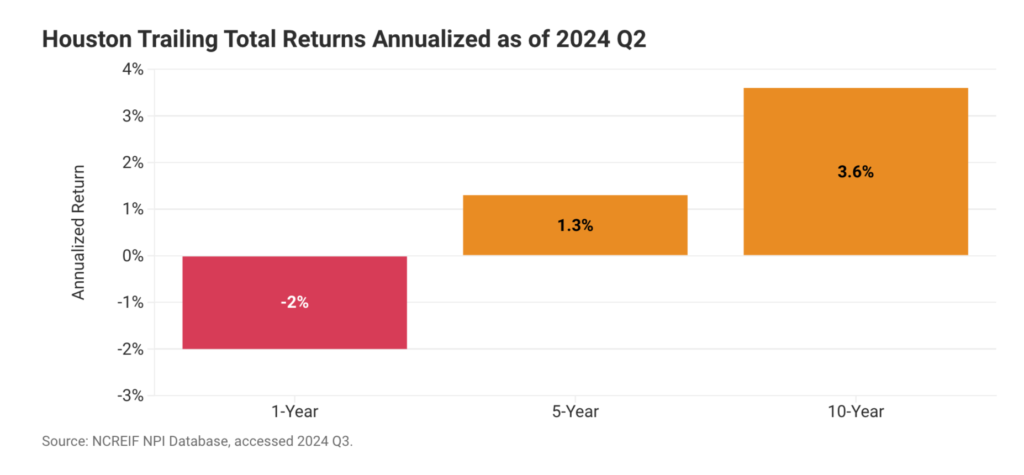

The metro has also seen annualized some of the best five- and 10-year returns on real estate of 7.9% and 8.8% respectively. It is the only Texas metro area with that distinction, the report states.

Dallas & Houston: Side by side comparison of Realized Return

Despite the growth, D-FW has remained relatively affordable. Moody’s Analytics rates Dallas’ relative cost of doing business at 102% and cost of living at 113% of their national averages.

Median home prices in Dallas have increased almost 38% since the first quarter of 2020 to $382,000. That’s roughly in line with the national median sales price at just under $400,000, according to real estate company Redfin.

These home prices are about four to five times higher than the median household income in North Texas. The region is “not quite affordable in absolute terms, but less unaffordable than most other major housing markets,” according to the report.

The region’s affordability, growth and economic diversity should continue to attract new residents and businesses.

“Dallas continues to attract new businesses and residents who are capitalizing on our attractive economic climate, availability of new, highly skilled talent, and first-class developments. We are proud to be recognized as the top market and know that our momentum will support Urban Land Institute’s work to elevate solutions around housing affordability and workforce development created by our evolving landscape.” Tamela Thornton, executive director of ULI Dallas-Fort Worth, said in a statement.

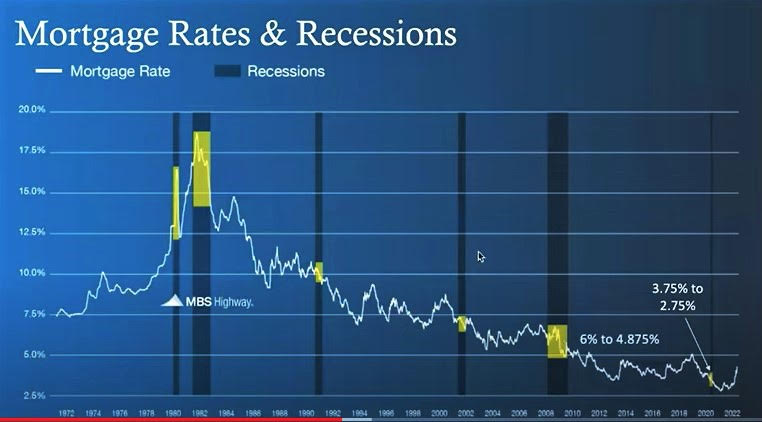

Nationally, the forecast for 2025 is more confident than last year, but industry leaders remain cautious. Experts say the nation is on the cusp of the next upturn in the real estate cycle. The consensus is that commercial real estate market recovery will be slow and gradual. Dallas will be one of the first markets to experience an accelerated growth in commercial real estate given its abundant flat land and its current residential real estate growth.

The report’s top 10:

- Dallas-Fort Worth

- Miami

- Houston

- Tampa – St. Petersburg

- Nashville

- Orlando

- Atlanta

- Boston

- Salt Lake City

- Phoenix