Real estate is a dynamic industry that is always in a state

of flux. Over the past few years, the Dallas-Fort Worth (DFW) area has

experienced significant growth and development. The region is one of the

fastest-growing areas in the country, and it is a hot spot for real estate

investors. In this blog, we will explore some of the recent trends in the DFW real estate market, including historic and recent statistics.

Historic Real Estate Trends in DFW

DFW has a rich history of real estate development. The region has seen multiple booms and busts over the years, but it has always managed to bounce back. One of the most significant trends in the history of DFW real estate has been the growth of the suburbs. In the 1950s and 1960s, the population of the area grew rapidly, and developers responded by building vast subdivisions on the outskirts of the cities. This trend continued through the 1990s, with developers building larger and more luxurious homes in the suburbs.

Another significant trend in DFW real estate history is the impact of oil booms and busts on the market. The oil industry has always played a critical role in the economy of DFW, and its fortunes have been closely tied to the real estate market. When oil prices are high, the real estate market tends to boom, and when prices drop, the market cools off.

Recent Real Estate Trends in DFW

In recent years, the DFW real estate market has been hot, with strong demand for housing and commercial real estate. One of the most notable trends has been the growth of the rental market. The region has seen an influx of young professionals and students, and many are opting to rent rather than buy. According to a recent report by Zillow, the median rent in DFW is $1,600, which is slightly above the national average.

Another trend in the DFW real estate market is the growth of the luxury home market. As the economy has improved, high-end buyers have returned to the market, driving up demand for luxury homes. According to a report by Forbes, sales of homes priced over $1 million increased by 28% in 2021 compared to the previous year. This trend is expected to continue as the economy continues to grow.

Finally, the DFW commercial real estate market has also been strong in recent years. The region has attracted major companies like Toyota, State Farm, and Liberty Mutual, and developers have responded by building new office buildings and industrial spaces. According to a report by CBRE, the DFW office market has seen steady growth over the past few years, with the vacancy rate dropping to 14.3% in 2021, down from 16.2% in 2020.

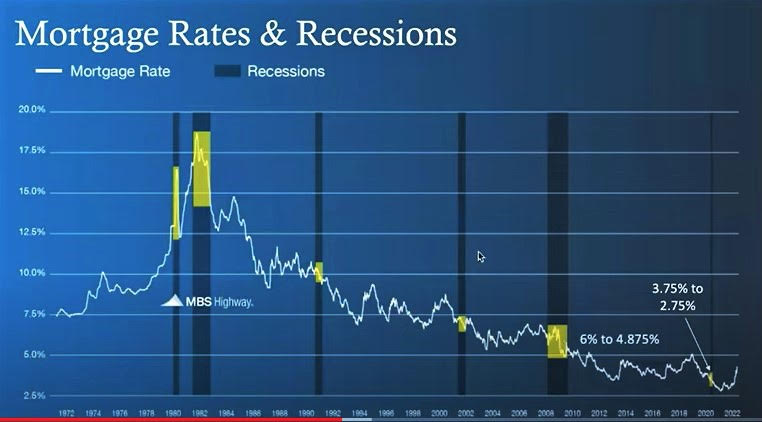

In 2021, the DFW real estate market continued to perform well despite the pandemic. The median home price increased by 14.8% compared to the previous year, with the average home selling for $339,900. This strong performance was driven by low-interest rates, strong demand, and a limited supply of homes for sale.

According to a report by Zillow, as of September 2021, the DFW housing market remained strong, with home values increasing by 20.3% year-over-year. The median home value was $317,600, and Zillow predicts that home values will continue to rise in 2022, although at a slower pace.

In the commercial real estate market, the office sector was the strongest performer, with 5.5 million square feet of positive net absorption in 2021. The industrial sector also performed well, with 28.7 million square feet of new construction completed, and a vacancy rate of only 5.6%.

If you have any questions regarding this or other subjects that I may be of help with some feedback, I am more than happy to make time and chat. Cheers, and invest smart!

* Disclaimer:

Real Estate investments are not all the same and may involve the risk of loss. The opinions on this blog represent the author’s perspective based on personal and professional experience. We cannot promise or foresee any market changes, nor be responsible for any potential outcome thereof.